Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time.

In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. Enrollment with Zelle through Wells Fargo Online® or Wells Fargo Business Online® is required.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. For your protection, Zelle should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle. Neither Wells Fargo nor Zelle offers a protection program for authorized payments made with Zelle.

To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle through their financial institution. Small businesses are not able to enroll in the Zelle app, and cannot receive payments from consumers enrolled in the Zelle app. Transactions between enrolled users typically occur in minutes. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement.

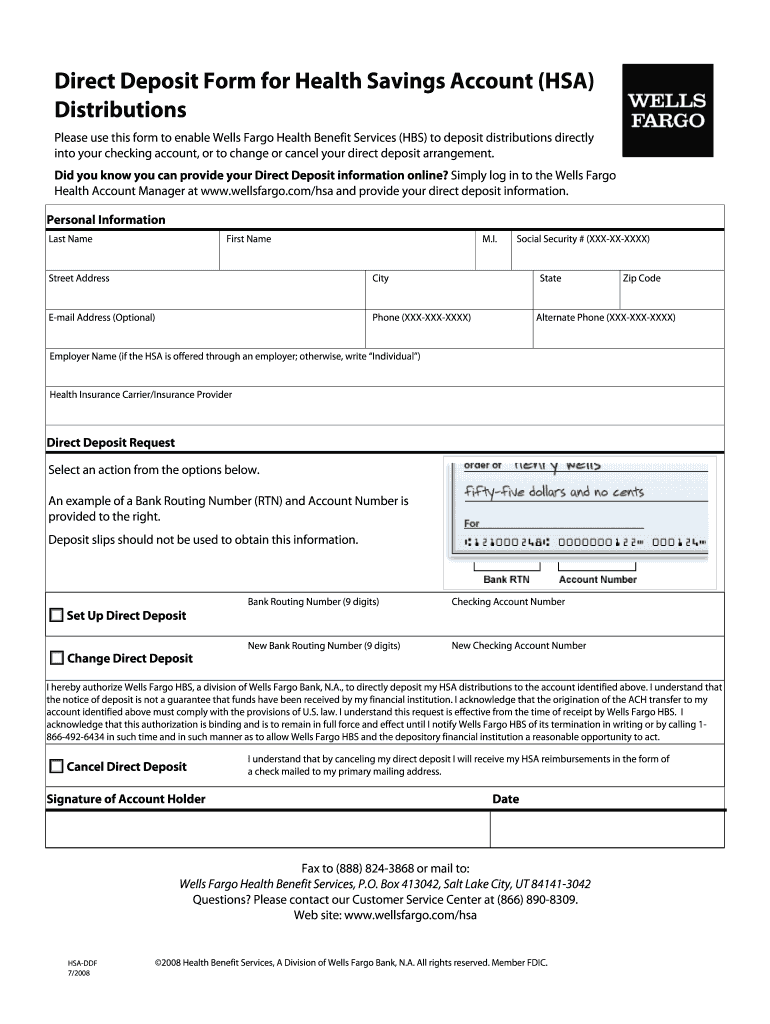

Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone.

For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Wells Fargo's Way2Save savings account has a $25 initial deposit requirement and has a $5 monthly service fee. You can also avoid the fee by setting up a monthly transfer to your savings or enrolling in a program that moves a $1 from your checking to your savings each time you pay a bill or swipe your debit card. The account has an APY much lower than the national average. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made.

Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Turning off your debit card is not a replacement for reporting your card lost or stolen.

Turning your card off will not stop card transactions presented as recurring transactions; transactions using other cards linked to your deposit account; or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the debit card will also be turned off. Availability may be affected by your mobile carrier's coverage area.

When you provide a phone number to us, you agree that you own or are authorized to provide the telephone number to us. To help protect your account security, Wells Fargo does not support SMS or MMS functionality for recognized VoIP, prepaid or landline phone numbers. In order to receive text messages from Wells Fargo, such as one-time passcodes or suspicious activity alerts, an eligible phone number and mobile device are required. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period.

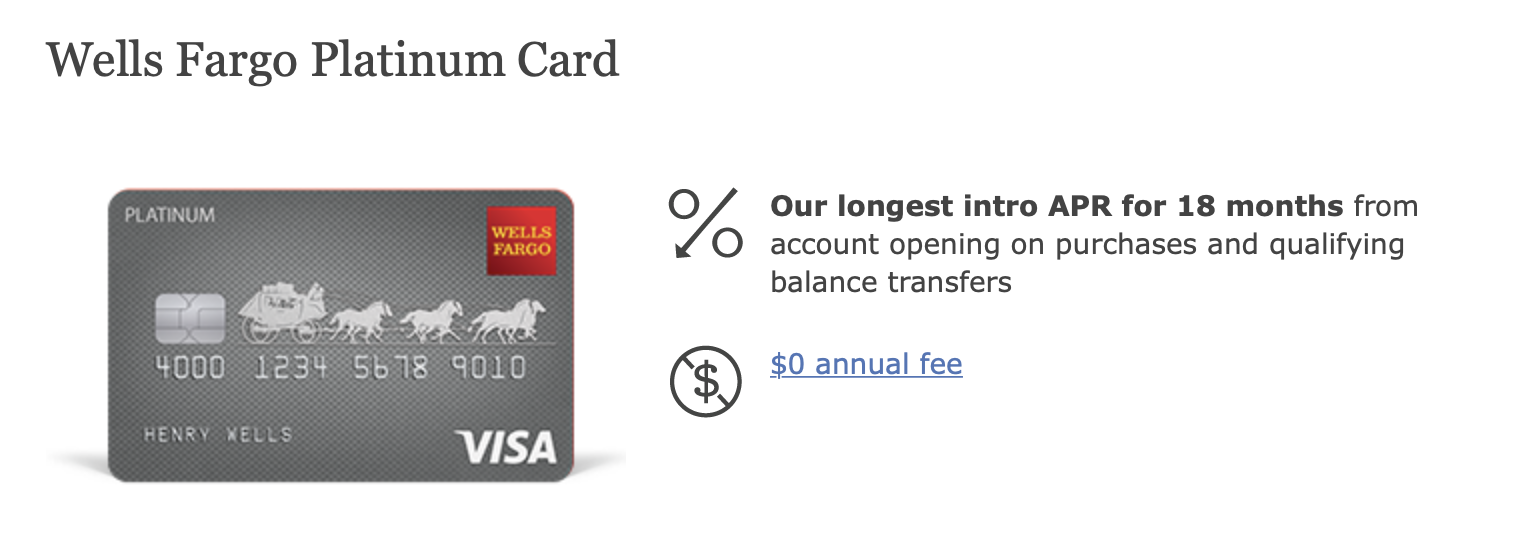

Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems.

Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service.

Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations. Wells Fargo may automatically send you certain alert messages via email, text message, push notification, and/or by other means, including to your mobile device. These messages may include notifications about potential fraud on your accounts, debit card or credit card, recent account activity, or changes to your online profile. You can opt not to receive push notifications by turning off push notifications on your Wells Fargo Mobile app. A Funding Account may not be used to pay any part of the balance you owe on that Funding Account.

Eligible Accounts that require two or more signatures or authorizations to withdraw or transfer funds may not be used as a Funding Account. A Funding Account must remain linked to the Service in order to use the Funding Account for current, future and automatic Bill Pay payments. Wells Fargo does not charge a fee to send, receive, or request money with Zelle. However, your mobile carrier's message and data rates may apply if you use Zelle on a mobile device. For most debit card purchases, we receive the payment request, including the actual transaction amount, within three business days of the transaction. We then remove the transaction from your list of pending transactions and add the funds back to your available balance.

Note that these liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and do not apply to business accounts. Our account agreements regarding unauthorized debit card, ATM Card, Wells Fargo EasyPay®, and consumer and business credit card transactions may give you more protection, provided you report the transactions promptly. Please see the agreement you received with your ATM, debit card, Wells Fargo EasyPay, or consumer and business credit cards, and the Eligible Account agreement. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank.

Other banks have attempted to emulate Wells Fargo's cross-selling practices . Overdraft Protection is an optional service you can add to your checking account by linking up to two eligible accounts . We will use available funds in your linked account to authorize or pay your transactions if you don't have enough money in your checking account.

The service is subject to applicable transfer and advance fees. Overdraft Protection is not available for Clear Access Banking℠ accounts. For more information, please refer to the Deposit Account Agreement and Fee and Information Schedule applicable to your account, or visit wellsfargo.com/overdraftservices. By texting IPH or AND to 93557, you agree to receive a one-time text message from Wells Fargo with a link to download the Wells Fargo Mobile® app. Please refer to the Supported Browsers and Operating Systems page for mobile OS details.

Megabank Wells Fargo offers large networks of branches and ATMs and a variety of financial products. Monthly fees on basic bank accounts can be easily waived, but savings rates tend to be low. If you have a Wells Fargo mortgage or investment account — or a high enough bank balance — you could receive upgrades on interest rates and fee waivers. Founded in 1852 as a bank and express delivery company, Wells Fargo offers a full range of banking services, including checking accounts, savings accounts, CDs, money market accounts, mortgages and other loans.

See Wells Fargo's Online Access Agreementfor other terms, conditions, and limitations. If you have family members who look like you, we recommend using your username and password instead of Face ID® to sign on. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the bank. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant. Set up is required for transfers to other U.S. financial institutions, and may take 3–5 days.

Customers should refer to their other U.S. financial institutions for information about any potential transfer fees charged by those institutions. See Wells Fargo's Online Access Agreement for more information. Wells Fargo Business Online provides access to both your business and personal accounts online. You'll know that your deposit is available when the amount appears online in the available balance of the Eligible Account you selected when you submitted your mobile deposit. You can check account balances, pay bills, or transfer funds; quickly find an ATM or branch location; receive and send money with people you know and trust using Zelle®; and receive alerts to track your account activity. Wells Fargo's overdraft fee is $35, with a maximum of three fees per day.

You can use your Wells Fargo savings account or line of credit as a backup source of funds, but there is a $12.50 transfer fee each time money is moved from savings to checking to cover an overdraft. If you take the time to waive the paper statement fees by switching to online statements, Wells Fargo's monthly fees are slightly better than those at other major banks. However, the real advantage at this bank comes with the large variety of options. For instance, neither Chase nor Bank of America —Wells Fargo's two closest competitors —carry any options specifically marketed to customers whose credit or banking histories prevent them from getting approved for accounts elsewhere.

The Wells Fargo Opportunity Checking Account gives such "toxic" bank customers an opportunity to get back into the mainstream banking system. Charges may apply, however, for the Wells Fargo Same Day Payments ServiceSM. Please refer to our fees page for fees associated with our online services. Account fees (e.g. monthly service, overdraft) may also apply to your account that you make Bill Pay payments from.

Please refer to the Account Agreement, including the Fee and Information Schedule, applicable to your account. You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other U.S. financial institutions. Wells Fargo gives you flexibility, convenience, and control to transfer funds where and when you need it. Simply sign on to Wells Fargo Online to access transfers, and click Add Non-Wells Fargo Accounts to get started.

All deposits that are immediately available and withdrawals that have posted to your account. It is adjusted throughout the day as we authorize or receive notice of pending transactions. Some pending deposits, such as incoming wire transfers, electronic direct deposits, and cash deposited at a Wells Fargo branch or Wells Fargo ATM, are available for your use on the day we receive the deposit. The bank paid millions of dollars to affected consumers and made leadership changes in the wake of the scandals. As of the time of publication, the bank is under investigation by the Consumer Financial Protection Bureau for previous debit card usage requirements for customers to waive monthly fees. This segment services business clients and high-net-worth individuals by offering them wealth management services, as well as investment and retirement products.

Some of these services include financial planning, credit, and private banking. Capital One also has a 360 Performance Savings Account that boasts a 0.4% APY. These rates are far higher than what you can earn with any Wells Fargo product, at any balance.

If you're willing to give up banking in person, Capital One's bank accounts may present better value than Wells Fargo. Wells Fargo offers several other products and services outside of its personal deposit accounts. The bank offers many credit cards, including several popular rewards and cash back credit cards. Only select Android devices are eligible to enable Biometric Sign-On . If you have family members who look like you, we recommend using your username and password instead of Biometric Sign-On to sign on.

SM. Please refer to our fees page for fees associated with our online services. Additional fees may apply for certain funding accounts used in Bill Pay. A portion or all of your check deposits made at a Wells Fargo branch or Wells Fargo ATM may be immediately available for your use on the day of the deposit, unless a hold is placed.

Funds not available on the day of the deposit will be available the next business day or after any applicable holds are removed. A check deposit made before the displayed cutoff time will be used by us to pay your transactions in our nightly process. Occasionally, a hold will be placed which prevents withdrawal of the money until a later date.

Further details are provided in our Funds Availability Policy in the Account Agreement. Only select devices are eligible to enable sign-on with facial recognition. If you have family members who look like you, we recommend using your username and password instead of facial recognition to sign on. Access to Zelle®, which allows customers to send and receive money with friends, family and others they know and trust who have a U.S.-based bank account, typically in minutes1 directly from one deposit account to another.

Wells Fargo checking accounts with direct deposit have a feature called "Overdraft Rewind," which can erase fees for customers who receive direct deposits the day after overspending. Community banking net income was $7.4 billion in 2019 on total annual revenue of $85 billion. You can make automatic deposits to this account through Save As You Go transfers. The program transfers $1 from your checking to savings account whenever you make non-recurring debit purchases and any online bill payment transactions. Like Wells Fargo, Capital One places a good deal of focus on small business accounts. Most banks, including Wells Fargo, limit a business's free transactions to about 500 per month or fewer.

Wells Fargo offers several investment services, including self-directed and automated investing. Wells Fargo provides IRAs, mutual funds, rollover accounts and college savings accounts for retirement and education planning. In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.